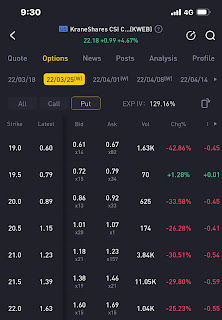

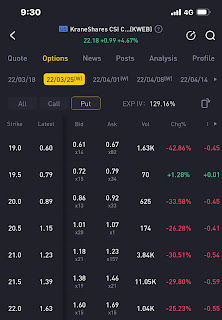

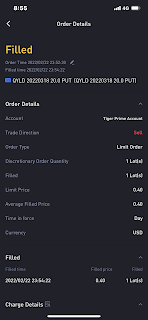

I sold 3 sell put on QYLD . As I average down . Was planning to even pick up the share on expiration total earnings near to 92 usd in premiums The share was 20.69 when I sold the first then went down to 20.20 the down to 20.00 as I did it . But as IT went lower fest starts and didn’t add any contract . Over all my 10000 usd of contracts options fetch me around 110 usd for Feb to March